Everything You Need to Know About Bank Gambling Blocks

Topics

We’ve put together a guide on everything you need to know about bank gambling blocks to help you understand the tool.

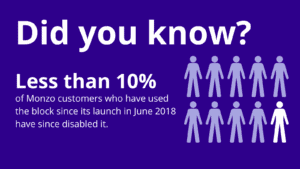

Bank gambling blocks are an effective tool to be used as part of recovery, particularly when combined with self-exclusion and blocking software.

What is a bank gambling block?

Bank gambling blocks are free tools offered by most UK banks to help get your gambling under control. They work by blocking transactions that are categorised as gambling – whether you’re gambling online or at a physical venue.

Bank gambling blocks allow for an extra layer of friction to help stop yourself from gambling. It is an important tool that can support your gambling recovery and is best used alongside blocking software and self-exclusion schemes to layer up protection. Find out more about other tools here.

Gambling blocks are applied at card level. If you have multiple cards, blocks will need to be set up for each card. You can set up a gambling block in your mobile banking app, by calling your bank or by visiting your local branch. Check the table below for how to block gambling on your bank account.

Most bank gambling blocks can be enabled in the mobile banking app. Some banks refer to the gambling blocks as ‘card freezes’ or ‘gambling restrictions’, and they can be found under ‘card control’ or ‘merchant control’ settings. Despite the variation in name, they all have similar functionality.

Gambling transactions on credit cards are now banned in Great Britain.

Will the use of a bank gambling block affect my credit score?

The use of a gambling block is not shared with credit reference agencies and does not affect your credit score. However, if you have regular gambling transactions on your bank statements, lenders may consider this when assessing your eligibility.

What is a cooling-off period?

The cooling-off period is the time between switching off your bank gambling block, to when your bank continues to allow gambling transactions. This period is usually 48-hours or 72-hours, depending on the bank. The decision to gamble can often be impulsive, so this is an extra step to provide you with time to reflect on your decision, and decide whether gambling is the right choice for you.

Which banks and e-wallets offer gambling blocks?

Set up: Telephone

Cooling-off period: 72 hours

Set up: App, Telephone, In branch

Cooling-off period: 48 hours

Additional tools:

- Set a cumulative monthly spending limit for gambling transactions (debit card)

- Block ATM cash withdrawals (credit card)

Set up: App, Telephone, In branch

Cooling-off period: 72 hours

Additional tools:

- Set a spending limit for a single debit card transaction

- Block or change ATM cash withdrawal limits

- Track spending in app

Set up: App

Cooling-off period: 48 hours

Set up: Telephone, In branch

Cooling-off period: 72 hours

Additional tools:

- Set up monthly gambling spend limit

- Limit ATM cash withdrawals

Set up: App

Cooling-off period: 72 hours

Set up: App, Telephone, In branch

Cooling-off period: 48 hours

Additional tools:

- Set a cumulative monthly spending limit for gambling transactions (debit card)

- Block withdrawals from ATMs (credit card)

Set up: App, Telephone, In branch

Cooling-off period: 72 hours

Additional tools:

- Limit ATM cash withdrawals

- Self-exclude from lending

Set up: App, Telephone, In branch

Cooling-off period: 48 hours

Additional tools:

- Set a cumulative monthly spending limit for gambling transactions (debit card)

- Block withdrawals from ATMs (credit card)

Set up: App, Telephone, Web chat

Cooling-off period: multiple options, from 2 days up to 1 year

Additional tools:

- Limit ATM cash withdrawals (telephone/web chat)

- Write a note to remind yourself why you turned on the block (in-app)

- Self-exclude from lending (telephone/web chat)

- Gambling block available for business customers (in-app)

Set up: Telephone, In branch

Cooling-off period: 48 hours

Additional tools:

- Limit ATM cash withdrawals

- Gambling block available for business customers

Set up: App

Cooling-off period: 72 hours

Set up: App, Website

Cooling-off period: 72 hours

Set up: App

Cooling-off period: 48 hours

Set up: App, Telephone, In branch

Cooling-off period: 48 hours

Additional tools:

- Limit ATM cash withdrawals

- Gambling block available for business customers

Set up: App, Secure Chat (Mastercard only)

Cooling-off period: 48 hours

Additional tools:

- Limit ATM cash withdrawals

- Free text alerts when your balance has fallen below a set limit

- Check your gambling spend in My Money Manager mobile app

Set up: App

Cooling-off period: 48 hours

Set up: App, Telephone, In branch

Cooling-off period: 48 hours

Additional tools:

- Self-exclude from lending

Set up: App, Telephone, In branch

Cooling-off period: 48 hours

Additional tools:

- Limit ATM cash withdrawals

- Gambling block available for business customers

Set up: App, Telephone

Cooling-off period: 48 hours

Additional tools:

- Block cash withdrawals from ATMs

Support Hub: A Free Service by Experian

Support Hub is an consumer facing product designed to empower people with support needs by allowing them to share their needs with multiple organisations in one go. This free service simplifies the process of communicating any access needs to essential services such as banks, utility providers, and more.

- Avoid Multiple Conversations: No need to contact each organization individually—Support Hub handles it for you.

- Save Time: The process takes just a few minutes, with updates provided when organizations register your request. You can update or remove your support needs anytime.

- Get Additional Support: Receive personalized assistance from service providers based on your circumstances.

- Explore Support Options: Access a list of support options to choose what’s important to you.

- No Credit Score Impact: Sharing your support needs won’t affect your credit score or access to credit. Organizations use the information solely to provide better service.

How long does a bank gambling block last and how do you remove the block?

Bank gambling blocks last indefinitely. If you wish to remove the block, you can often switch it off through your banking app, or you may be required to contact your bank directly and speak to customer services. The block will not switch off straight away, there will always be a cooling-off period before you’re allowed to continue making gambling transactions.

Can I set up a block on a joint account?

If you have a joint account with someone who gambles, you won’t be able to set up a bank gambling block on their behalf or for the account as a whole. For joint accounts, each person has to set up their own gambling block.

My partner/friend/child gambles. Can I set up a block on their behalf?

Unfortunately, you can’t act on someone’s behalf unless you have power of attorney. If you are a power of attorney holder and apply a bank gambling block, the blocks will also be applied to your card. Find out more about how you can protect your finance from our factsheets.

Banks should automatically block gambling transactions on under-18 accounts, but do speak to the bank if you find that isn’t the case.

What if the block doesn’t work?

If you have an active gambling block, your bank will attempt to block all transactions categorised as gambling. If a gambling transaction goes through, report it to your bank, as the gambling company may be using an incorrect Merchant Category Code (MCC). Your bank may not be able to block gambling if you purchase a lottery ticket as part of your grocery shopping, or you are using a different payment method, such as an e-wallet or faster payments.

If you’re struggling with gambling, speak to your bank – they may offer additional support, including blocking transactions to specific merchants.

Bank gambling blocks are a great tool for layering up protection to help you stop gambling. If you’re worried about your own or someone else’s gambling, our Helpline advisers are available 24/7 to give specialised advice tailored to your situation. Get in touch with us.

Topics