How business banks can reduce gambling related financial harm

Topics

When most people think of a business expense, marketing, payroll, or office supplies come to mind. However, gambling transactions can be made, without friction or checks, from business accounts with most high street banks in the UK.

Through our National Gambling Helpline, GamCare is hearing cases where business funds are being staked by employees, company directors, and self-employed people – many of whom are particularly vulnerable to gambling related financial harm due to their access to large sums of money in their business accounts, which should be set aside for ordinary business expenses.

Michelle Franklin, business owner:

“My son was gambling from our business account as often as he liked. Our business debit card was linked to multiple gambling sites. Despite thousands of gambling transactions, neither the bank, our bank manager, nor our accountants questioned it; it was simply logged as director’s dividends. We lost our home, our business, and nearly lost our son… ”

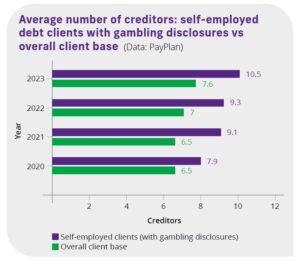

There is evidence that gamblers running a business experience greater levels of debt. PayPlan, one of the leading debt advice providers in the UK, have reported that clients who are self-employed and disclosed gambling harm end up with more creditors (see the graph below) possibly because the business status enables them to borrow (and gamble) at even greater levels.

The Business Debtline, a charity that provides free debt advice to small businesses across the UK, are also seeing how gambling can negatively affect businesses.

Dawn Jennings, Information Officer at the Business Debtline:

“For some of our clients, gambling had put their business under extra financial strain, making it more difficult for them to trade. For others, it has simply led to the closure of their business.”

To highlight this issue, GamCare’s Gambling Related Financial Harm (GRFH) project brought together leaders from financial services firms, debt advice agencies, the gambling industry, gambling support organisations, as well as people with lived experience.

Following this workshop, we are now calling on the business banking sector to take action in these key areas:

- Raising awareness and staff training

Banks providing business accounts should use the wide range of data they have to better understand the scale of gambling harm across business bank accounts, and analyse how best to foresee and prevent gambling related financial harm.

They should ensure that the staff are trained to recognise gambling harm and bank managers are confident to discuss gambling transactions on the account, and can signpost clients to gambling support if necessary.

2. Blocking gambling on business accounts

Despite gambling transactions being a personal expense, only a small number of business bank account providers (e.g. Monzo, Tide) are currently blocking gambling transactions, and a few others (e.g. Santander, NatWest) offer an opt-in gambling block at customer’s request.

Firms should assess the risks of allowing gambling transactions on business accounts and should consider blocking gambling transactions as standard (the same way it has been done for credit cards and under-18 bank accounts).

3. Transaction monitoring to identify gambling harm

Some retail banks in the UK have started monitoring data to spot unaffordable gambling and proactively contact customers to offer help and support, but this isn’t being done within business banking.

Banks allowing gambling transactions on business accounts should use transactional data to spot harmful gambling on client accounts (e.g. looking out for repetitive and escalating gambling spend or gambling across multiple gambling operators) and flag these accounts for further intervention.

4. Intervention and support

Detection without an appropriate intervention is largely ineffective and business banks are well placed to prevent foreseeable harm and support their customers experiencing gambling harm.

Banks should communicate to business customers about gambling harm in a sensitive, non-judgemental and supportive manner. Firms should normalise conversations about gambling harm in the business banking sector to help break the stigma about the topic and provide resources and education about the risk of gambling harm tailored to business customers, e.g. through websites, banking apps, direct customer communications.

Firms should work in collaboration with the gambling support sector and people with lived experience to develop these processes and interventions.

Read the full report

Topics