Cost-of-living crisis: new research lays bare the challenges facing gamblers

Topics

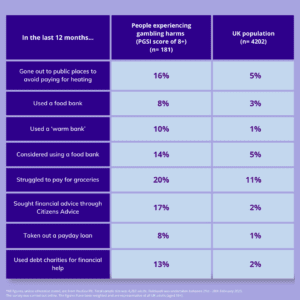

People who are gambling at harmful levels are ten times more likely than the general population to have used a warm bank in the past 12 months, according to new research from YouGov.

The survey of 4,202 UK adults, commissioned by us, also found that one in six (16%) people gambling at harmful levels had visited public spaces to avoid escalating energy costs, compared to just 5% of the UK population.

Over the past year, advisers on our National Gambling Helpline have heard numerous reports of how the rising cost-of-living is impacting the lives of callers. During the past 12 months, advisers have heard from callers who have been using betting shops as a warm bank, people on Universal Credit gambling to make extra money to cover their bills, as well as people on disability benefits who have turned to the activity to try and make ends meet.

The data highlights that parents with gambling issues are particularly feeling the impact. Half (50%) who had gambled at harmful levels said they had gone without essentials like food or washing clothes to afford something for their child in the past 12 months, compared to 20% of UK parents overall.

Similarly, parents who had gambled at harmful levels are almost three times more likely to have struggled to buy children’s school uniforms in the past 12 months than parents overall, with over four in ten (44%) indicating so compared to one in seven (14%) of parents.

In addition, the data suggests that people gambling at harmful levels could be more likely than the general population overall to view the activity as the solution to their financial challenges, despite being more likely to report they are feeling the impact of rising costs. Four in ten (42%) believe that gambling will help improve their financial situation in the next 12 months compared to just seven per cent of UK adults.

The data also shows that people gambling at harmful levels are:

- Twice as likely to be concerned about their job security than the rest of the UK population. (50% and 26% of workers respectively)

- Seven times more likely than the rest of the UK population to say they will gamble more in the next 12 months as a result of the cost-of-living crisis. (42% and 6% respectively)

- Nearly four times more likely to say they had chased their losses compared to the general public overall. (92% and 25% respectively)

- Twice as likely to use a prepayment meter than the general population, with 15% indicating so compared to 7% of UK adults overall.

- Eight times more likely to have taken out a payday loan in the last year than the general population. (8% and 1% respectively)

- Six times more likely than the rest of the UK population to have used debt charities for financial help in the last year. (13% and 2% respectively)

In addition, of those who had gambled in the past 12 months, four in five (79%) of the UK population said they had lost money doing so, with 5% losing a significant amount.

New Money Guidance Service for Gamblers

The findings from the YouGov survey are being released today as we launch the national roll-out of our new Money Guidance Service, which will work with people who have been financially impacted by gambling to help them get back on track. The scheme was piloted across Leeds and the East Midlands earlier this year and is now available nationwide to anyone calling the National Gambling Helpline or enlisted in our support services.

The service will provide money guidance to help people understand their spending habits, manage their budgets, recognise spending triggers, establish boundaries for them and suggest other changes they could make. The service is also open to people who are affected by someone else’s gambling and will work with them to improve their own financial position.

Anna Hemmings, Chief Executive Officer:

“The rising cost-of-living is continuing to impact some sections of society harder than others, and the data from YouGov shows the challenges are particularly acute for people experiencing gambling harms . What we are still seeing is a proportion of those who are hit the hardest by the cost-of-living crisis being the ones looking towards gambling to ease their money worries.

At GamCare, we know first-hand that gambling isn’t a way to ease money worries, as well as how important it is to address the financial picture to support someone’s longer-term recovery from harm. We hope with the launch of our Money Guidance Service that more people can explore their relationship with gambling, but also have an opportunity to get a deeper understanding of how gambling could affect their finances going forward.”

We held a webinar on March 31st to discuss this latest research, find out more and watch here >>

If you are concerned about your own, or someone else’s gambling, then we are here to support you. Speak to a trained adviser on our Helpline, available 24/7, for free.

Topics