Lloyds Bank customers now able to set personalised gambling spend limits

Topics

Lloyds Bank customers will now be able to set personalised monthly limits on how much they spend each month on gambling using their debit card, as part of a trial.

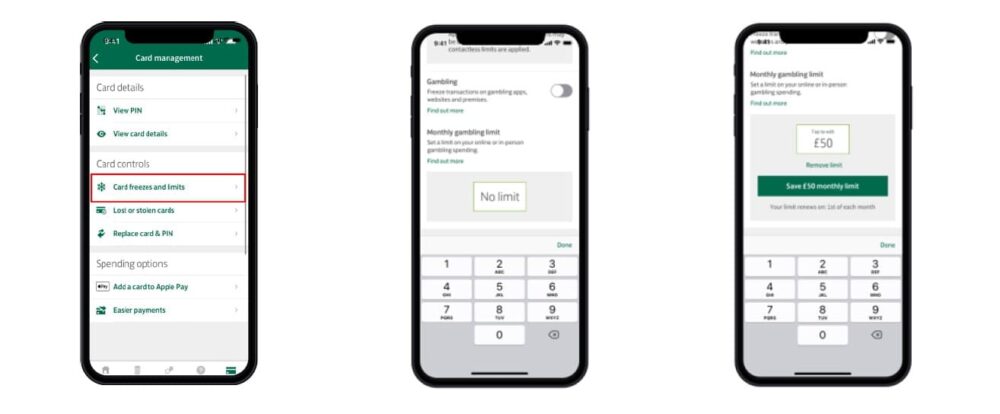

The feature – the first of its kind offered by a UK high street bank – allows customers using the Lloyds Bank mobile app to set a monthly debit card gambling limit of any amount to the nearest whole pound, when spending online, in person or over the phone.

Research from the Gambling Commission shows that approximately one in three UK adults participate in gambling (excluding lotteries), and up to 3% of UK adults are estimated to be at some risk of harm due to their gambling, of which 0.3% is considered to be ‘problem’ gambling.

Research carried out by Lloyds Bank found that 50% of people would like banks to take further action to help prevent gambling harm, with monthly gambling limits being one of the most supported features amongst respondents.

This feature is being launched to understand how helpful customers find the ability to set a monthly limit, alongside the existing ability to freeze gambling transactions completely.

Further control

Lloyds Bank also allows customers to freeze gambling spend completely, introduced in November 2019. This freeze blocks gambling payments – including a unique ‘defrost’ period – which means customers can remove the block at any time but must wait 48 hours before they can resume spending on gambling. The freeze service is available on both Lloyds Bank debit and credit cards, while limit setting is available on debit cards only currently.

The addition of setting monthly limits, which gives customers more control in budgeting how much they are spending on gambling, can be adjusted or removed at any time and will automatically roll on each month, until the limit is removed.

Philip Robinson, Director, Personal Current Accounts at Lloyds Bank:

“For several years, we’ve helped our customers ‘turn off’’ gambling spend. Our newest feature lets customers set a personalised gambling spend limit, helping them better manage their money and establish boundaries around certain spending behaviour.”

Anna Hemmings, GamCare CEO:

“As many households are having to think more carefully about their budgets, the launch by Lloyds Bank of its new in-app gambling spend limit feature will give those most vulnerable to gambling harms an important means of controlling their gambling – and preventing harms from escalating. This tool complements the range of existing support features that we can recommend to people reaching out for help.”

Find out more about what Lloyds and other banks offer to help prevent gambling via our Money Management section. If you’re concerned about your gambling, speak to our National Gambling Helpline.

Topics