New research shows gamblers face greater impacts of cryptocurrency investing

Topics

People are experiencing harm from investing in cryptocurrencies and other high-risk trading products, experiencing similar difficulties that people report with gambling harms, according to new research from YouGov.

Our National Gambling Helpline received almost 200 calls in the past two years from people who have disclosed that they struggled with online financial markets, including cryptocurrencies.

This includes accounts of people losing over £50,000 through their trading, and young adults who spent mortgage deposits on cryptocurrency but ultimately lost large amounts of money to it.

A recent YouGov survey of over 4,200 UK adults, commissioned by us, reveals that investors of cryptocurrency are more likely to report they have lost money on their investments (40%) than gained money (34%).

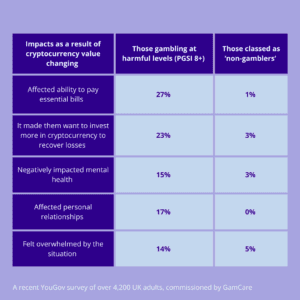

It also found that those gambling at harmful levels* were almost five times more likely to own cryptocurrency than the general population (51% vs 11%), while also being more likely to experience more negative impacts as a result of cryptocurrency trading.

Raminta Diliso, Financial Harm Manager:

“For many consumers, cryptocurrency purchases are a way to diversify their investment portfolio. However, what we have seen on the National Gambling Helpline over the past few years is that serious harm can occur if it goes too far and it’s not always the get-rich-quick opportunity some people may think it is.

“The volatility and unpredictability of these currencies can sometimes create a similar environment to gambling, where people are starting to chase the rush rather than feel they are engaging in a financial activity.”

Harriett Baldwin MP, Chair of the Treasury Committee:

“The Treasury Committee recently took a close look at the state of the cryptoasset market.

“The sharp peaks and drops in the value of cryptocurrencies clearly demonstrates the risks speculating on them can pose to consumers.

“Trading of cryptocurrencies, like Bitcoin, is equivalent to gambling. By betting on these unbacked ‘tokens’, consumers should be aware that all their money could be lost.”

Topics