YouGov survey shows link between gambling losses and worries about rising cost of living

Topics

To mark our 25th anniversary year, we look into the key issues surrounding gambling harms today, from the increases in cost-of-living to cryptocurrency, to raise awareness and encourage those impacted to reach out for support.

We commissioned a survey with You Gov, asking a nationally representative sample of 4000 people, across the UK, for their views on key issues from online gambling and sport betting to newer activities facing gamblers today.

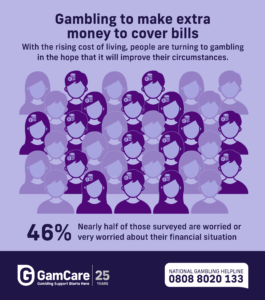

Helpline advisors report callers gambling to make extra money to cover their bills

We run the National Gambling Helpline, open 24 hours a day, seven days a week.

Our advisors are increasingly hearing from callers who are talking about how the rising cost of living is affecting their lives. People can turn to gambling in the hope that it will improve their circumstances, but it inevitably makes things worse.

- You Gov data shows nearly half (46%) of those surveyed are worried or very worried about their financial situation. The figure is significantly higher in those who report losing significant amounts of money gambling; 61% of this group are worried or very worried about their finances

Recently, advisors have reported that a number of callers, on Universal Credit, are gambling as a way to make extra money to cover their bills but have unfortunately ended off in a worse financial situation as a result. Advisors on our Helpline have also reported repeat callers, who previously felt they had recovered from gambling, but have relapsed as financial pressures have heightened and have needed to seek more support for their gambling. Callers have also reported increasing costs as a barrier to tackling their existing debts through gambling and are further struggling to pay them back.

Our latest annual figures show that 75% of gamblers and 53% of affected others using the National Gambling Helpline reported financial difficulties, and 66% of gamblers disclosed having debt. In treatment, 80% of gamblers and 56% of affected others reported financial difficulties and 66% of gamblers reported debt.

Increased accessibility of online gambling and prevalence of traditional gambling

The rising cost of living coupled with the increased accessibility of online gambling, which was, at times, the only form of gambling available during the pandemic, can be particularly challenging for those harmed by gambling. Despite the increased popularity in newer forms of betting such as skins and loot boxing, more traditional forms of betting like horse and greyhound racing are still prevalent today.

- The YouGov data shows that horse racing (36%) followed by football (21%) are the most popular sporting events to place a bet on in the last 12 months

- Problem gamblers and those with a moderate level of problem gambling mostly bet on football matches (56% and 60%) and horse racing (29% and 48%)

- Six in ten (59%) of 16–24-year-olds who gamble have not placed a bet on a sporting event in the last 12 months, but a 17% of this group report that they own cryptocurrency

High-risk trading and investing, such as cryptocurrency, are a growing concern for problem gamblers

As well as traditional gambling- like football or horse race betting- GamCare is seeing new concerning trends, primarily the growing risk to consumers from high-risk trading and investing, including cryptocurrencies. Although many people invest without experiencing harms, there is an increasing concern for people experiencing issues related to cryptocurrencies, particularly for problem gamblers.

The survey data suggests that those who have experienced serious gambling harms are more likely to experience negative impacts when trading.

- 43% of problem gamblers own cryptocurrency

- Two thirds of low-level problem gamblers (66%) are motivated to buy cryptocurrencies to make money, this is significantly higher than problem gamblers (24%)

- Those whose gambling is classed as problematic are much more likely to report negative impacts from purchasing cryptocurrency than the general population. One quarter (25%) of this group want to invest more to recoup their losses (v 7%), 22% say they have not been able to pay essential bills (v 4%) and 21% say they have felt overwhelmed by the situation (v 6%)

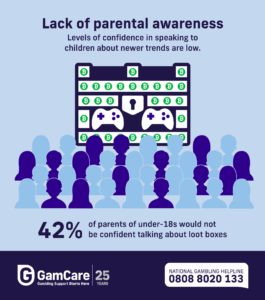

Lack of parental awareness

GamCare is becoming aware of new activities that could pose a risk in the future. Nearly a fifth (17%) of all 16- to 24-year-olds surveyed said they owned cryptocurrency, with 16- to 34-year-old males being the most likely to report owning cryptocurrencies – 33% have bought it at some point. The survey also shows that parental awareness and levels of confidence in speaking to children about newer trends are low.

- Half of parents of children aged under 18 (51%) would feel unconfident explaining what cryptocurrency is

- 42% of parents of children aged under 18 would not be confident talking to their children about loot boxes, compared to a third of this audience (33%) who would. Among all parents, the number of women (50%) who are not confident is higher than men (33%)

- 79% of parents of children aged under 18 have never heard of skins betting

If you are a parent or guardian who is concerned about young people gambling, we have resources available on our youth-orientated website, Big Deal. We run the Young People’s Gambling Harm Prevention Programme, with Young Gamers and Gamblers Education Trust (YGAM). We can help you learn the facts about gambling, understand its relationship with gaming items such as lootboxes or guide you on how to start the conversation. You can also book a free workshop led by a trained professional to get a more in-depth understanding and have your questions answered.

Anna Hemmings, Chief Executive:

“For 25 years, GamCare has helped people experiencing problems with gambling. Over this time, we’ve gained knowledge and expertise from working collaboratively, including with people who have lived experience, on how to best support those affected by gambling harms – including gamblers, their family and friends.”

Anna continues:

“Our helpline advisers are hearing that the cost of living is impacting people’s gambling behaviours- particularly those gamblers who have recovered. We are currently developing a new in-house Money Guidance Service to better support people using our services, with financial difficulties and debt.

We also know that our team are hearing from more and more people who are reaching out for help around crypto trading.It is concerning to see the survey data, which suggests that those who have experienced serious gambling harms are more likely to experience negative impacts when crypto trading, such as chasing their losses, feeling overwhelmed and not being able to pay their bills.

As we turn 25, and look to the upcoming Gambling Act Review, we will continue to raise awareness of gambling issues, including newer trends, and become more accessible to help people spot the signs and reach out for support. We urge anyone who is struggling with gambling to contact us. Whether you’re concerned for yourself or for others, we’re here to support you.”

To mark our anniversary, and speaking about their experiences as gamblers, S Club Singer Jo O’Meara, who speaks about her gambling for the first time, and former footballer Peter Shilton, alongside his wife Steph Shilton, are urging those who struggle with gambling to reach out for support.

The trio were interviewed in a short film by Matt Burgiss, who delivers education and training programmes at GamCare, and has lived experience of gambling addiction.

Topics